A multi-faceted

software platform for corporate governance,

loan management and transaction monitoring.

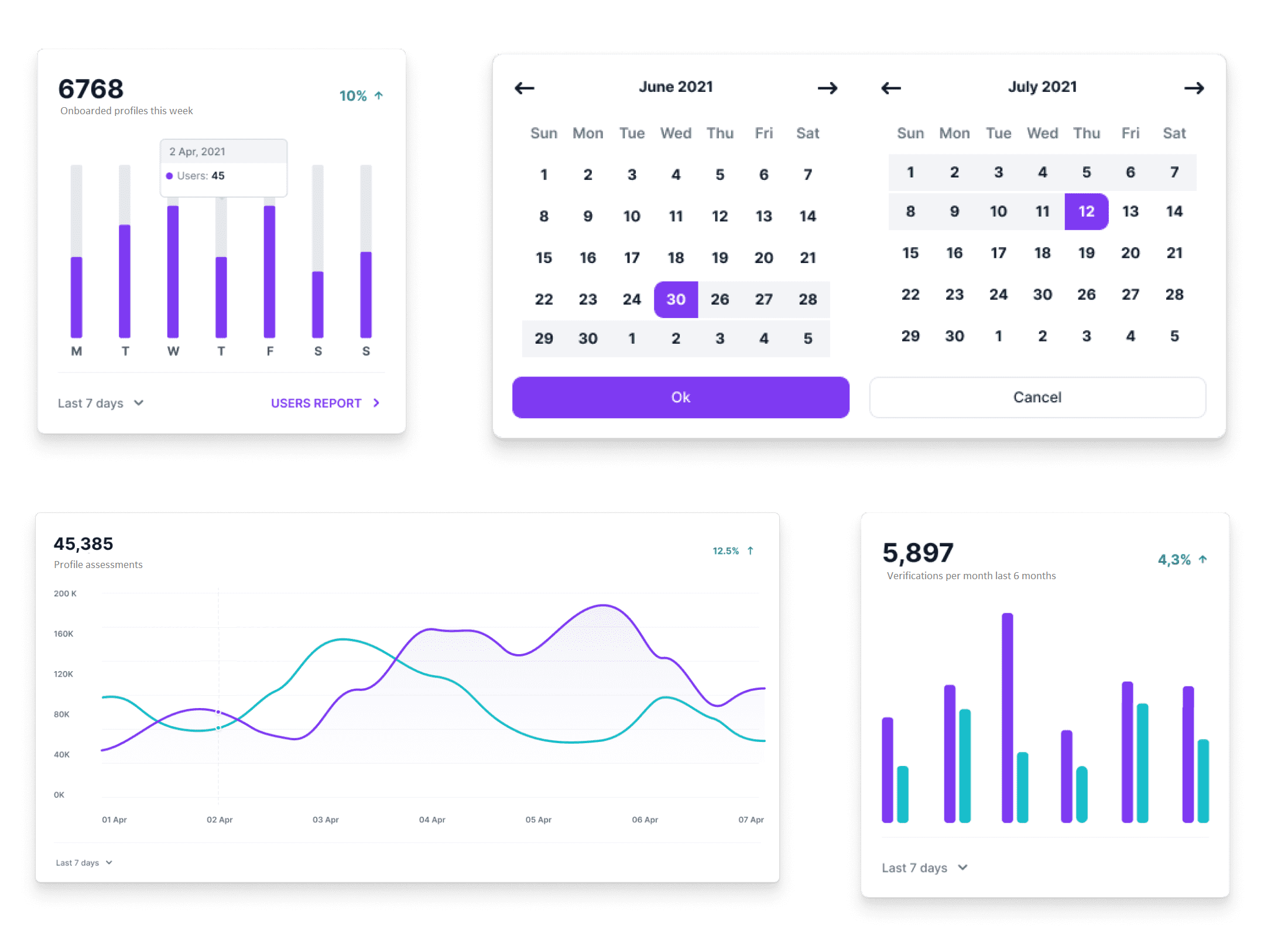

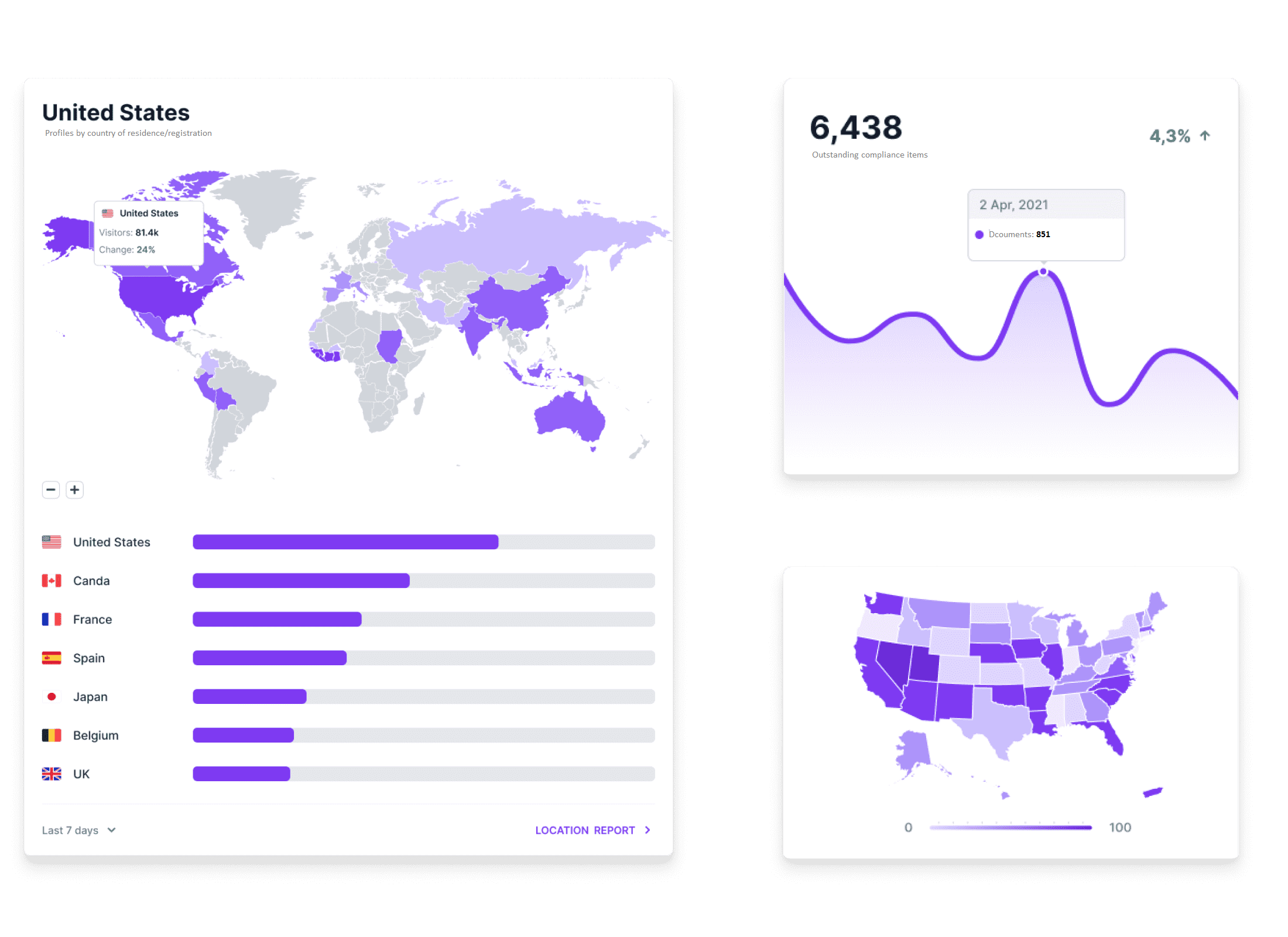

The Orbulis platform, by GRADA, is a full and complete corporate governance solution that enables automated onboarding of clients, continual monitoring of onboarded profiles, risk monitoring and bespoke reporting.It also offers a best of breed loan management solution and transaction monitoring for the banking sector.